We do a reverse calculation considering the discount you want to give and the GST rate and create your invoice. That is, if you know the final amount of the item you are selling is INR 2,000 and you want to create an invoice with taxes calculated based on this final amount, you can use the MRP calculator. MRP calculator is used for calculating the taxable amount per item if you know the final item value.File will be functional of Windows XP if the system has Excel 2013 or newer version installed.I have Windows XP? Does it work on that?.No, All the features don’t work for Mac.

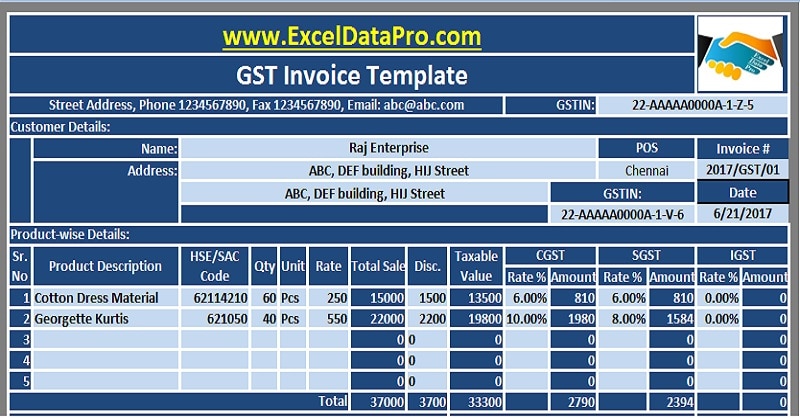

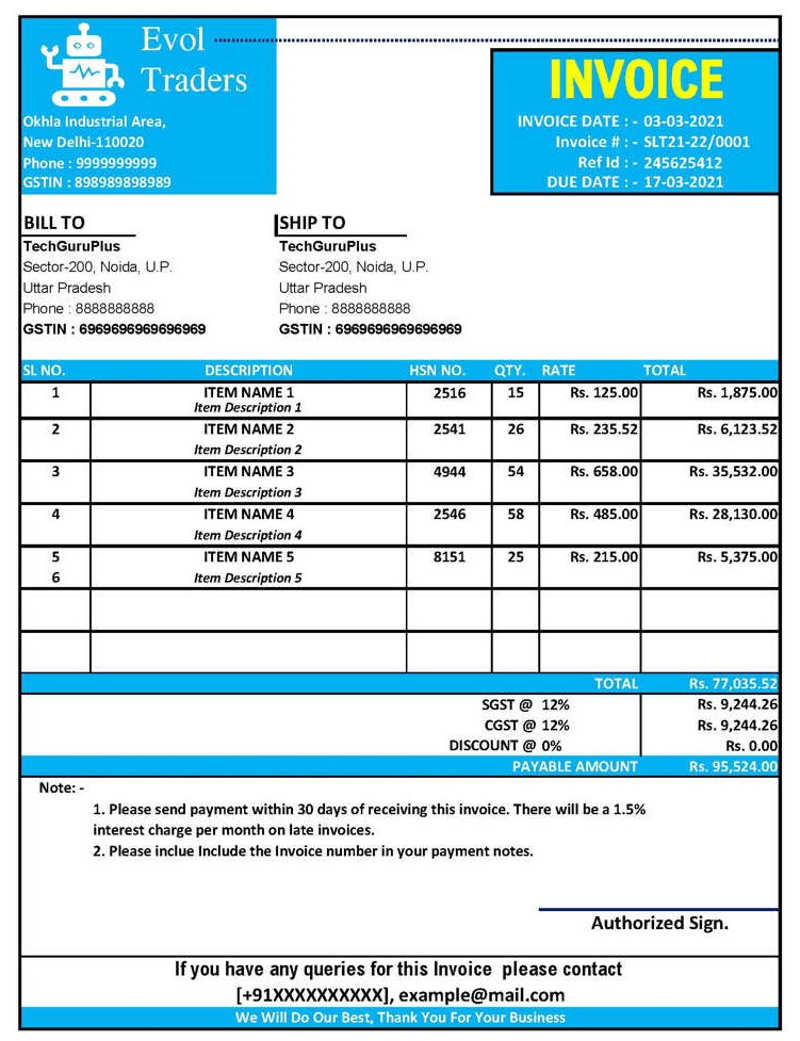

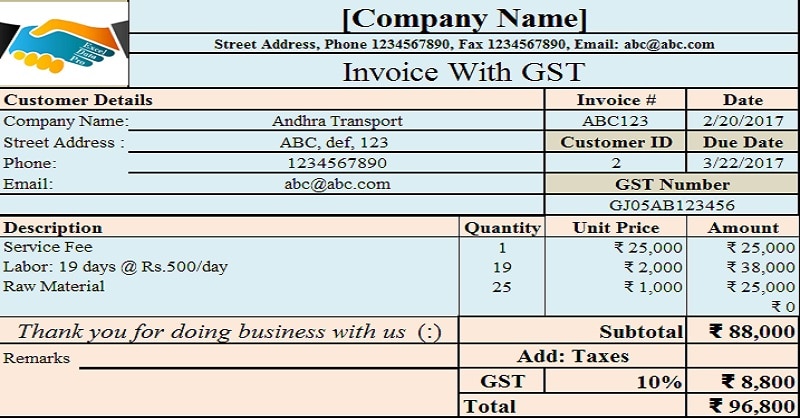

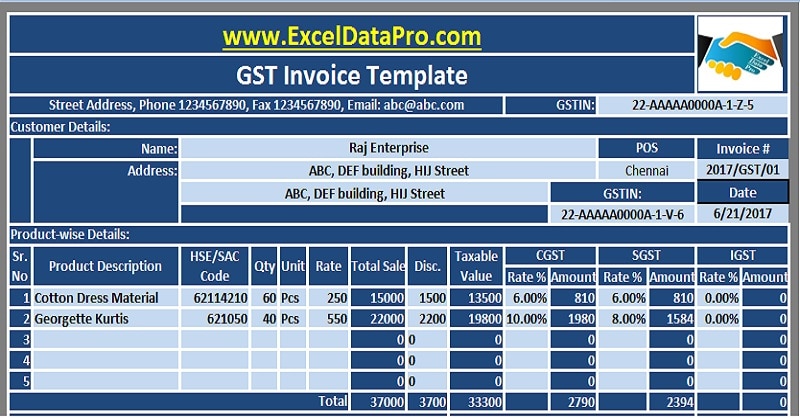

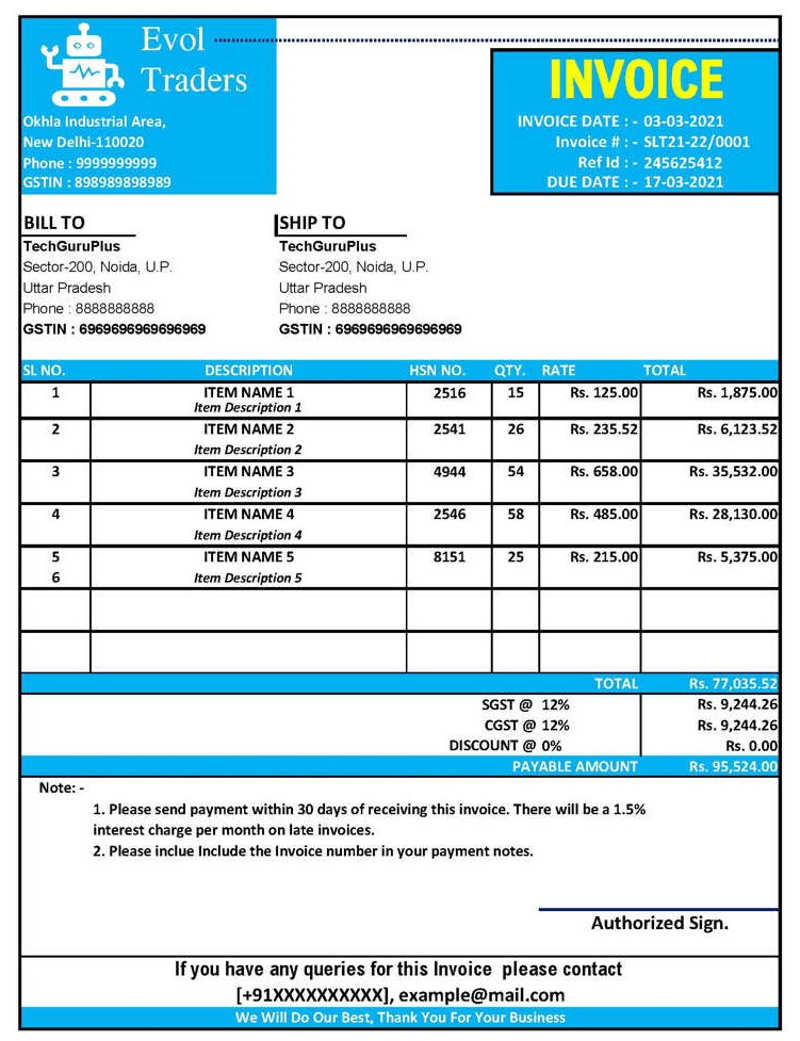

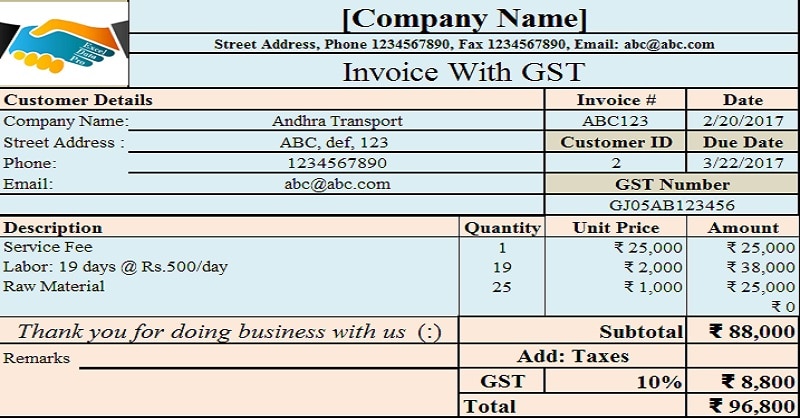

When you open the Utility, you will be asked to ‘Enable editing’ and ‘Enable macro’. My GST Excel Invoicing Offline Utility isn’t working properly. Using ‘/’ in your invoice number will lead to issues in printing the same For example, if you want to create invoice with the number ‘’Sales/GST/17-18/2′, please use ‘Sales-GST-17-18-2’. When I create an invoice with special characters, I am unable to print the invoice. They can also share the data with their CAs/ Tax Professionals for filing. Businesses can later use this invoice data to file GST returns through ClearTax GST software. ClearTax GST Offline helps them create GST bills without internet. Creating GST bills can be very hard for them. Many business do not have internet connection. What is this GST Excel Invoicing Offline Utility for? Is this for billing, accounting or filing?. If you’re an Excel 2007 user, install this plugin to run the Offline Utility Software.

When you open the Utility, you will be asked to ‘Enable editing’ and ‘Enable macro’. My GST Excel Invoicing Offline Utility isn’t working properly. Using ‘/’ in your invoice number will lead to issues in printing the same For example, if you want to create invoice with the number ‘’Sales/GST/17-18/2′, please use ‘Sales-GST-17-18-2’. When I create an invoice with special characters, I am unable to print the invoice. They can also share the data with their CAs/ Tax Professionals for filing. Businesses can later use this invoice data to file GST returns through ClearTax GST software. ClearTax GST Offline helps them create GST bills without internet. Creating GST bills can be very hard for them. Many business do not have internet connection. What is this GST Excel Invoicing Offline Utility for? Is this for billing, accounting or filing?. If you’re an Excel 2007 user, install this plugin to run the Offline Utility Software.

0 kommentar(er)

0 kommentar(er)